The mission of the GYVI GALI organization is to increase the availability of plant-based food in Lithuania. In order to know how the situation is changing, it is important to monitor trends in various sectors. In 2022, we were the first in the country to announce it report on consumer attitudes towards plant-based foods and nutrition. This time we are undertaking a new analysis - we aim to examine and evaluate how retail chains respond to the growing demand for plant products, and to identify possible supply gaps or opportunities for further development of the assortment. in 2023 In December, we conducted a survey in the stores of the five largest shopping chains.

This study of the plant assortment in Lithuanian retail chains not only reveals the current situation, but will also allow us to observe how the assortment of plant products in the country changes over time - it is planned to be carried out regularly.

In addition, similar studies, which have been carried out for several years in other countries, such as Latvia, Germany, Belgium, the Czech Republic, Slovakia and even Chile, allow Lithuania not only to follow the national market trends of plant products, but also to perform a comparative analysis with other countries. This provides an opportunity to assess where Lithuania stands in the context of the development of plant-based nutrition, to identify the strengths of the sector and to promote the diversity of plant-based products and increasing their availability to consumers.

Methodology of investigation

In the study, we analyzed the assortment of retail chains, taking into account the variety of products and price policy. The study evaluated plant-based alternatives to animal products that help facilitate the transition to a plant-based diet or diversify an existing diet.

While performing the evaluation of the plant assortment in Lithuania, we relied on Albert Schweitzer Foundation recommendations, with the help of which research of a similar nature has been going on in other countries for several years. We collected data based on the availability of the same type of product in a category, for example, how many different plant-based milk products are available in a store, counting individual brands and product types. In order to determine the supply of different categories of products in stores of the same network and to compare the results with each other, averages were conducted based on the number of stores visited. The number of products found in the stores of each supermarket chain was summed and divided by the number of stores visited, thus obtaining an average average for a particular supermarket category.

Research object

In the course of the study, the offer of the vegetable assortment in the five largest retail chains in Lithuania was analyzed and evaluated: UNTIL, LIDL, Maximum, Norfa and Rimi, including stores of different sizes in major Lithuanian cities. This made it possible to get a more detailed picture of the offer of the herbal assortment and its availability to various consumer segments and to assess how different locations and store sizes affect the offer of herbal products.

The assessment included analysis of different product categories such as plant-based meat and fish alternatives, vegan mayonnaise, plant-based alternatives to milk and milk products, desserts, ready meals and convenience foods. The study focused on plant-based alternatives to animal products, so vegetables, fruits, various grains, legumes and similar products were not included in the evaluation. In addition, the proportionality of prices was taken into account when analyzing the price differences between vegetable milk and cow's milk, in order to predict the influence of the price difference on consumer choices. This product category was chosen for price comparison not by chance - plant-based milk is one of the most popular plant-based product categories, due to its compositional properties it is suitable both for people who eat a plant-based diet or those who are sensitive to it, as well as for people who cannot consume cow's milk due to intolerance or allergy.

General trends

The widest selection was observed in the categories of plant-based milk and its product alternatives and meat alternatives. These categories are characterized by the greatest variety of products, more or less available in almost all the chains that participated in the study. Different plant-based meat alternatives (plant-based mince, steaks, sausages, meatballs, etc.) average between 2 and 15 products, depending on the chain. Plant milk - from 4 to 26 different types or brands of milk.

Meanwhile, some other categories, such as plant-based fish and seafood alternatives and ready-to-eat categories, remain with very limited supply to date. This shows that although plant-based nutrition is becoming more and more popular and supermarkets are trying to expand their range, there are still segments where plant-based alternatives are not sufficiently developed. There are opportunities for retail chains and manufacturers to look for ways to expand the assortment in these niches and present new, innovative products to consumers that meet modern nutritional trends and consumer expectations.

In the table, we present the evaluated product categories and the highest and lowest average of available products, including data from all five evaluated retail chains. The minimum offer is not recorded in the table, if at least one retail network does not find products of this category.

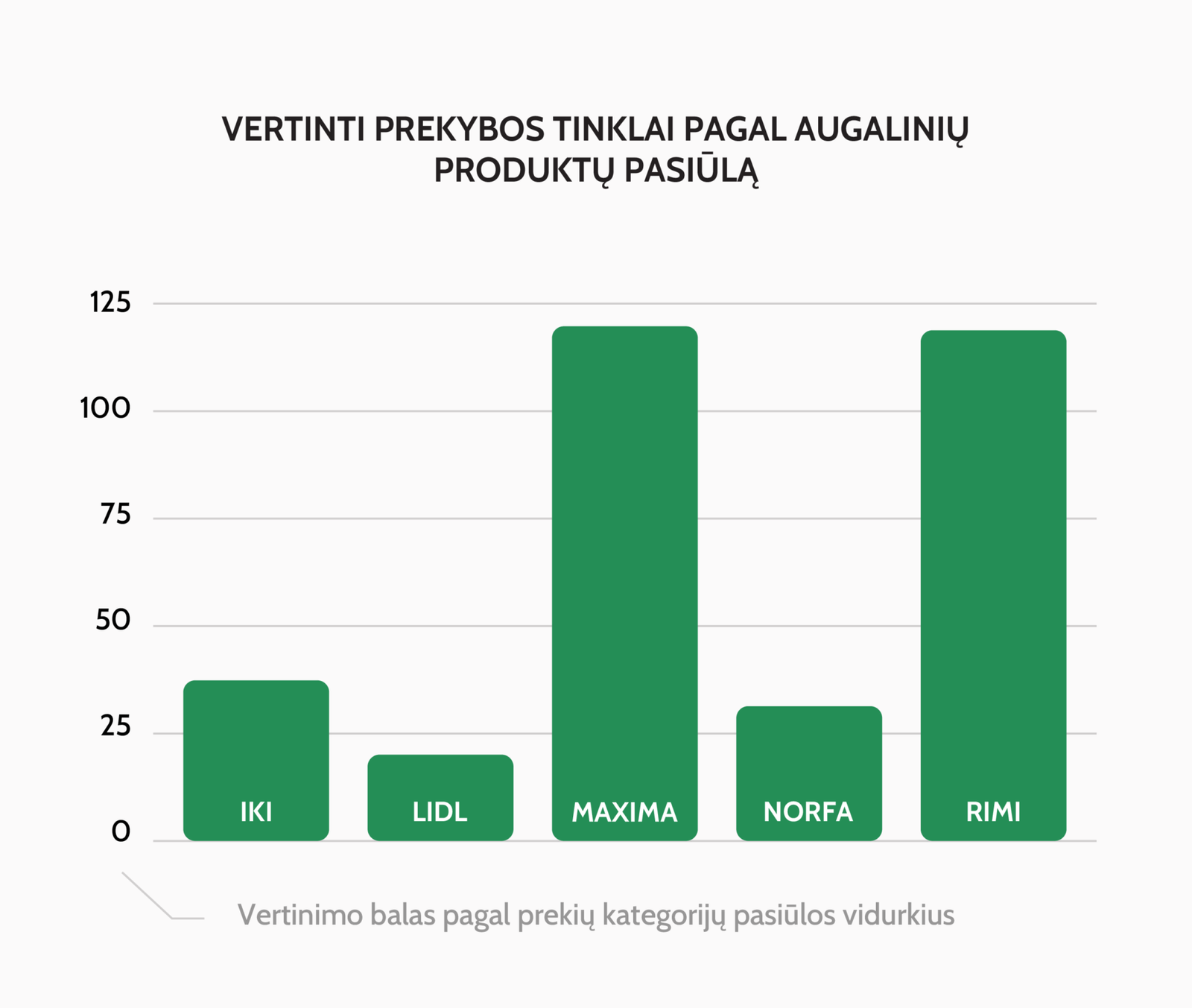

Two clear leaders stood out

After examining the offer of plant products in the Lithuanian retail sector, two obvious leaders emerged - Maximum and Rimi Shopping networks. They feature a wide range of plant-based products, especially plant-based milk and dairy alternatives - yoghurts, creams for cooking, plant-based cheeses and other products, and meat alternatives - in both frozen and ready-to-eat categories. In addition, the assortment of these retail chains is enriched with a wide selection of plant-based ice cream.

Although in the pre-prepared food category, both leaders can still improve their offered assortment, the wide selection in other plant-based product categories allowed them to clearly stand out and take leading positions compared to the other three retail chains. This advantage shows that Maximum and Rimi responds responsibly to the growing consumer interest in herbal alternatives, and is ready to meet modern trends, offering consumers a variety of high-quality herbal productskt.

After carrying out the evaluation of the range of plant products, it became clear that Maximum its offer is slightly ahead of the retail network Rimi. Although the advantage is not significant, it has been helped by the more developed categories of plant-based meat alternatives, which include both semi-finished products and frozen and ready-to-eat products. Maximum the largest selection of plant-based alternatives to fish was also found in the supermarket chain. In turn Rimi stood out for the extremely abundant offer of plant-based ice cream, plant-based cheese and yogurt, and plant-based cream for cooking. This small difference indicates a dynamic market situation where leadership positions can change rapidly.

It is important to mention that the purpose of the study was not to determine the nominees for the first or second places, but to review the general offer of plant products in Lithuania. The emergence of both networks as sector leaders is a favorable sign of the sector's potential for growth and innovation. This gives hope that other retail chains, inspired by these examples, will join in the expansion of the range of plant-based products over time, contributing to the popularization of healthier and more sustainable alternatives.

How are other networks doing?

After analyzing the research data, a clear gap can be observed between the leading and lower-ranking retail chains. Although we have noticed alternative plant products in them, the plant milk category is unequivocally the most widely developed, yet in terms of supply, they are significantly behind maxims or Rimi. To catch up with market leaders, they would need to expand across all valued categories. In many categories, including plant-based fish, ice cream, desserts, plant-based cheeses, yogurt and prepared foods, products were very minimal or could not be found at all.

Lidl the retail chain stands out for its line of plant-based alternatives Vemondo. We would like to see it continue to be developed, presenting in Lithuania products that are often found in chain stores in other countries.

Shopping networks UNTIL and Norfa, in turn, could expand the range offering by introducing more alternative herbal products, filling the missing categories. The location and size of the store have a big influence on the assortment.

The supply is influenced by the location of the stores

The study revealed that consumers' access to herbal products varies depending on where they live. It has been observed that stores in larger cities or larger stores of the same chain often offer a wider variety of herbal products, while smaller cities and more remote areas have a more limited range.

This situation not only exposes geographic differences in the availability of plant-based products, but can also limit consumer choices, especially for those who want to eat a plant-based diet but face the challenge of finding the products they need.

The price of plant milk is up to three times higher than animal milk

After comparing the data, it was noticed that the prices of vegetable milk in Lithuanian retail chains are significantly higher than cow's milk, reaching even two to three times higher amounts, when comparing the cheapest vegetable milk with the cheapest cow's milk and the most expensive vegetable milk with the most expensive cow's milk among all five visited retail chains . The price of plant milk ranging from EUR 1.59 to EUR 5.96 per one liter pack, compared to the price of cow's milk ranging from EUR 0.52 to EUR 3.79 per one liter pack, may deter some consumers, especially those for whom price is one of the deciding factors when building their shopping cart.

This price gap raises questions about the availability of plant-based milk to consumers and may limit the expansion of plant-based consumption. In order to promote a sustainable and healthy lifestyle, it is necessary to reduce the financial barriers related to the purchase of alternative foods.

Recommendations

Popularizing plant-based food is a complex task. Our organization believes that in order to increase the availability of plant-based food, the involvement of all parties is important - public education, business involvement and political decisions are needed. Below we present both general recommendations and recommendations prompted by the research results. We will also contact each of the retail chains for individual meetings where we will present the research results and personal recommendations specifically for them.

- Plant-based milk and its products are the most demanded category of plant-based products, so we recommend expanding their selection. It is important to include in the assortment not only plant milk, but also its products - creams for cooking, yogurts, cheese alternatives. This is especially relevant for retail chains with a smaller selection. If you are wondering where to start, this should be one of your first steps.

- Reducing the price barrier is one of the most important elements. The gap between animal products and their plant-based alternatives is holding back consumers from making choices that are more environmentally, healthily and animal friendly. Although the price is influenced by the production costs of the products, the markups of the outlets are no less influential. Since these are often still considered niche products, some retail chains choose to mark up higher prices for plant-based alternatives than conventional products. However, in order to encourage consumers to include more such foods in their diet, it is important to make it possible for consumers not to overpay for these products. Published last year LIDL and Kaufland foreign examples shows that by making it possible for consumers to buy plant-based products at the same price as animal-based products, interest in plant-based products is growing rapidly. However, this requires value decisions that are likely to pay off in the long run, but may require larger investments initially.

- In order to reduce the gap in smaller regions and smaller stores, as one of the possible options, we suggest creating a basic basket of plant products that could be standardly available in all chain stores, regardless of their size or location. This basket should include essential plant-based products such as plant-based milk and its products and meat alternatives to help ensure that consumers can easily meet their needs.

- Products should be labeled and advertised based on their taste, texture, fragrance or similar characteristics, not as "vegan". Such abstract phrases as "vegan steak" do not help the customer to form an impression of the product. A vegetable, mushroom or pea protein roast will give consumers a much clearer picture of what they are buying. At the same time, retail chains should avoid naming these product categories as products for vegans and vegetarians - the biggest target audience interested in plant-based products is flexitarians.

- We have noticed that necklaces marking vegan or vegetarian products are often misplaced in retail chains. In order to avoid improper labeling, retail chains could encourage their suppliers to get appropriate labeling on the product packages themselves - thus, retail chains would avoid liability for misleading consumers when, due to human error, beads or labels are placed incorrectly at the point of sale.

Sometimes even small changes can lead to significant results. We hope that the representatives of the retail chains will listen to our recommendations and next year, when we present the results of the repeated research, we will have an increased supply of herbal products. We, in turn, will educate the public about the importance of choosing such products.