Plant-based meat is becoming a stronger competitor to the traditional meat industry. Unfortunately, it still cannot compete with regular meat in one essential aspect - price.

Price is a problem

The average price of meat alternatives in the US reached more in 2019 than 18 euros per kilogram. This is double the price of beef (almost 9 euros per kilogram) and four times more than the average price of chicken (about 4 euros per kilogram). Frozen meat alternatives are cheaper at just over 12 euros per kilo, but this price can only be compared to veal (also more than 12 euros per kilo).

This price imbalance may become one of the hot topics in the coming years. With the impending global financial meltdown, “FAO” ("Food and Agriculture Organization", lit. "Maisto ir Žemes Ūkio Organizacija") predicts that the price of traditional meat will fall.

So can we plant-based meat consumers help these products compete with cheaper animal meat?

Frozen products - low price guarantee?

Through innovation in taste and marketing, Beyond and Impossible have started a plant-based meat revolution. Between 2013 and 2016, U.S. retail sales of plant-based meat rose only 1-3 percent, but since 2016 US plant-based meat sales began to rise by 16-18 percent every year.

How do these incumbents achieve lower prices? One factor, perhaps, is that it is not a role model: the brands Morningstar, Gardein and BOCA sell almost exclusively frozen products. Supermarkets usually charge less for frozen products than for products in refrigerators, because the latter are insured due to the higher probability of spoilage. However, research suggests that this could limit the potential of the products. Recently published PBFA-Kroger research claims that plant-based meat, which is in the refrigerated meat sections, is bought more often. According to available data, 67 percent of U.S. supermarkets stock at least some meat alternatives in these sections.

Two other factors behind the low prices may offer more hope: the focus on cheap ingredients and production efficiency.

Cheap ingredients, cheap products

One of the biggest trends in plant-based meat production is the use of new, unusual protein sources such as kidney beans, potatoes, fava beans, chickpeas, oats, lupins and beans. Some of these proteins also have practical and environmentally friendly benefits. But as the entire industry moves in one direction, new risks can emerge.

Much of the low price of chicken can be explained by the industry's choice to feed the animals cheap feed - corn, wheat and soy (11-28 cents per kilo). Morningstar, Gardein, BOCA and Lightlife also rely on these products - seitan flour, soy protein concentrate and isolate. These by-products are slightly more expensive than chicken feed and are sold for 93 cents per kilogram on Alibaba's wholesale portal.

Unusual proteins are much more expensive. On Alibaba, the prices of radiant beans start at almost 4 euros per kilogram, potato protein at 5.6 euros per kilogram, fava beans at around 7.5, chickpeas at just over 9, and lentil proteins at even more than 18 euros. . The slightly more common pea protein is cheaper (from €1.87 per kilo), but the more popular organic, non-GMO varieties are more expensive. Most of these crops are already grown on a large scale, so reducing their prices further can be a real challenge.

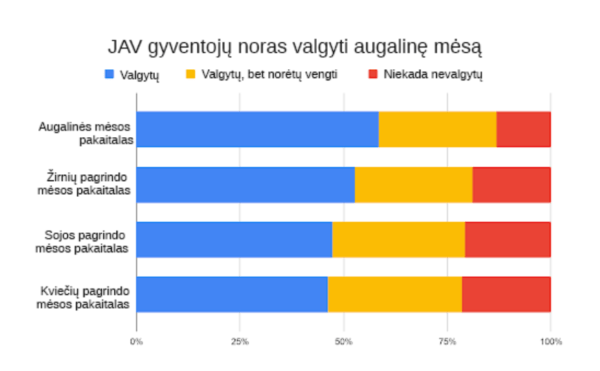

Industry insiders justify the trend toward using unusual proteins, explaining that consumers don't like soy and wheat proteins. They pay attention to the rapid expansion of soy- and gluten-free products in the United States. But is consumer opinion important enough to justify the price?

A new, unreleased survey by the organization Rethink Priorities investigated this question. The researchers found that slightly more Americans would prefer to eat a pea protein-based meat substitute than soy and wheat alternatives. However, even more respondents said they would prefer to eat conventional meat substitutes. This highlights the dangers of specificity - perhaps this is why the meat industry does not advertise its products as 'GMO soy-fed chicken'.

Nowadays, it's clear that the stigma around gluten and soy in the US has also affected the global market. 2017 survey shows that 2,000 Chinese consumers would like to try meat substitutes made from wheat or soy just as much as substitutes made from mycelium or potato protein. in 2017 most of the new plant-based meat products in Europe were created specifically from soy and wheat proteins.

Scale and simplicity

Another lesson would be to pay attention to relatively simple products. Morningstar, Gardein, Lightlife and BOC have another thing in common - they are all owned by giant food conglomerates: Kellogg, ConAgra, Kraft Heinz, and Maple Leaf Foods. This allows companies to produce on the scale of major companies, expanding production and distribution of products. Since the major companies have the most experience with processed products such as meat patties and chicken nuggets, their subsidiaries also focus on these areas.

On the other hand, most startups aim to recreate unusual products that regular plant-based eaters miss. Approaching demand gaps seems self-evident to most, as it helps companies stand out with their unique range. On the other hand, this decision often forces companies to rely on other manufacturers whose product quality and prices are constantly fluctuating.

Rebellyous Foods is a notable exception. This company produces only plant-based chicken nuggets, and strives to simplify and enhance the cooking process. Company manager Christie Lagally explains that most plant manufacturers rely on equipment that is not used for its original purpose. As a result, production speed and quality suffer, and skilled professionals often have to return to repair work.

In order to ensure production efficiency, Rebellyous follows the same strategy, which has been used successfully by the chicken industry. Since the 1930s, the chicken industry has not innovated more in technology— The invention of the McNuggets chicken nuggets is still the most impressive achievement. But only by drastically sacrificing the welfare of the hens has the industry been able to significantly reduce the price of chicken.

It seems that Beyond and Impossible companies are also learning from the chicken industry. They both settled on a few products and invested in their factories. "Beyond" reduced the prices of its production from a little over 8 euros to almost 7 euros per kilogram. Last year "Impossible" made the decision to use GMO soy, pulling away the displeasure of anti-GMO groups. It is believed that this decision was made to reduce the cost of ingredients.

The world's largest meat companies, Tyson, JBS and Cargill, has expanded its plant-based meat offering, which is drawing even more attention to its scale and price. Startups are likely to continue to lead the way in crop production innovation. However, to lower the cost and improve the taste of plant-based meats, we will need not only innovation, but also a corporate focus on efficient wholesale production. As consumers, we can help companies by buying their plant-based products. Every euro spent on plant-based nutrition shows the industry that these products are important to us. This will encourage the establishment of new companies, and more competition will lead to lower prices.

#

The article was translated from Lewis Bollard's Open Philanthropy Farm Animal Welfare Newsletter. All data and values are provided from this source.

If plant-based nutrition is still unfamiliar to you, we invite you to join 22-Day Herbal Discovery WISH YOU CAN Programs. She will surprise you not only with advice, but also with suggestions on how to replace animal products with plant products!